Jane bryant quinn explains the role of living trusts in estate planning

- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

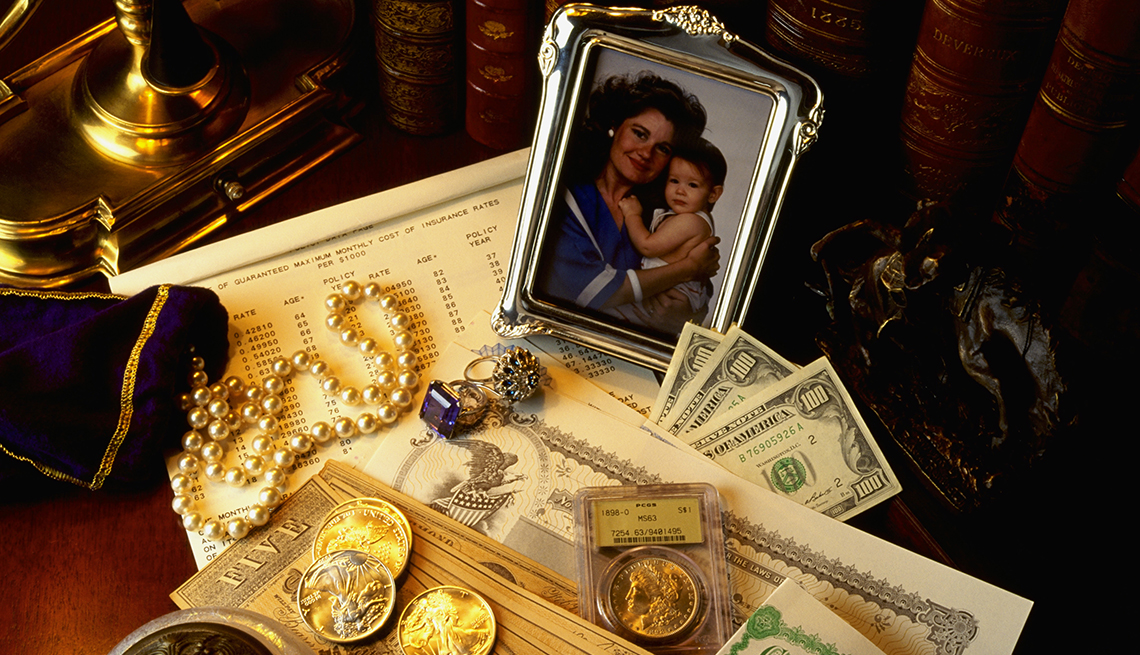

You have a will (I hope!), but is that enough? Would you and your heirs be better off if you created a living trust? These trusts often appear on the menu at free senior seminars, tempting

everyone to gobble them up. They can indeed be valuable — for specific financial and personal purposes. But sticking with a will may be better, and cheaper, depending on your state laws and

the amount of your assets. Like wills, living trusts (formally known as revocable trusts) list the people who will receive your property after you die, leaving you free to manage it while

you're alive. Unlike wills, trusts require that you give up direct ownership of that property. Instead, it's normally transferred, or “retitled,” into the trust. I'll say more

about this process in a minute. First, I'd like to make some general comparisons between wills and trusts. Living trusts avoid probate, which is often part of their appeal. Probate is

the legal process by which a will is accepted as genuine, creditors get paid and heirs receive assets to which they are entitled. With trusts, these functions are handled privately by a

trustee. The question for you is whether probate is worth avoiding. Many states have streamlined, simplified procedures for uncontested wills. They also have low-cost ways to probate modest

estates. (The site nolo.com has collected a list of states’ rules; if you live in, say, Ohio, type “avoiding probate in Ohio” in the site's search box, then scroll down the results to

Articles.) There's no probate at all for retirement accounts with named beneficiaries, joint accounts with survivorship rights, pay-on-death accounts and life insurance. If these types

of assets make up the bulk of your estate, a will works fine. FOR WAYS TO SAVE AND MORE, GET AARP’S MONTHLY MONEY NEWSLETTER. Trusts are useful, however, in certain situations — for example,

if probate is expensive (as it is in states where lawyers charge a percentage of the estate's assets, rather than flat or hourly fees); if you own property in more than one state (to

avoid double probate); or if you have assets that need ongoing management, such as business interests or trading accounts. In many states, living trusts can't be reached by creditors,

says attorney Gerry W. Beyer, a professor of law at Texas Tech University. With or without a trust, you can name backups to manage your affairs should you become disabled. If you don't

have a trust, you can give a power of attorney to a person you pick. With a trust, your chosen trustee will act. The transition might go a little more smoothly with a trust, but not

necessarily. Trusts require extra paperwork. You have to transfer all your property into your name as trustee. That includes the deed to your house, your bank and investment accounts

(usually excluding tax-deferred retirement accounts), valuable personal property and any new assets you acquire. You'll want legal guidance, which raises the cost of a living trust

compared with a basic will. If the transfers go wrong, your trust becomes a useless piece of paper. “I've seen this happen thousands of times,” Beyer says. Never buy a living trust form

off the rack. Ask an experienced lawyer what it can do and whether you need it at all.